On December 22, 2017 the Tax Cuts and Job Act added Opportunity Zones to the tax code. This new tax benefit is designed to spur economic development and job creation in underserved communities and provides opportunities for deferment, discounts, and even permanent shielding from taxes on capital gains for commercial real estate investors.

What Are Opportunity Zones?

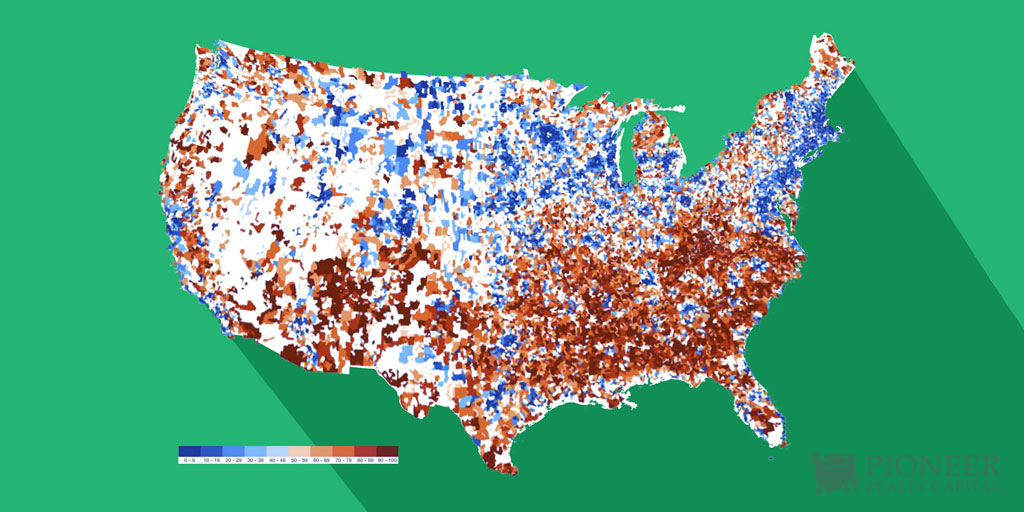

There are 8,700 U.S. Census tracts designated as Opportunity Zones. These zones were nominated by states and certified by the Secretary of the U.S. Treasury, and are economically distressed communities with an average poverty rate of 32 percent. There are zones in all fifty states, the District of Columbia, and five U.S. Territories including nearly all of Puerto Rico. The new tax benefits could funnel up to $100 billion into Opportunity Zone areas.

New tax benefits could funnel up to $100 billion into 8,700 U.S. census tracts designated as Opportunity Zones. Commercial real estate investors benefit from new tax laws.

How Commercial Real Estate Investors Benefit from the New Opportunity Zones Tax Law

Opportunity zones provide several tax advantages to commercial real estate investors. As an immediate benefit, taxes on prior capital gains invested into an Opportunity Zone can be deferred until the investment is sold, or until the end of 2026, whichever comes first. Additionally, there are benefits available for Opportunity Zone investments based on the length of time they are held: a 10% discount on the investment’s gain if held for longer than five years, and 15% if held for longer than seven years. Lastly, an Opportunity Zone investment held for ten years will also have any gains permanently shielded from taxes.

How Commercial Real Estate Investors Can Take Advantage of Opportunity Zones

Commercial real estate investors need to be certified as a Qualified Opportunity Fund (QOF) to take advantage of the tax benefit associated with Opportunity Zones. A QOF is a partnership or corporation formed for investing in Qualified Opportunity Zones. This means individuals, corporations, businesses including LLCs, REITs, and estates and trusts can participate if they are treated as a partnership or corporation for federal tax purposes. Investors do not have to live, work, or even have a business in an Opportunity Zone to participate; simply invest a recognized gain in a qualified zone and elect to defer tax on that gain.

New tax benefits could funnel up to $100 billion into 8,700 U.S. census tracts designated as Opportunity Zones. Commercial real estate investors benefit from new tax laws.

Structure Debt and Equity to Fund Commercial Real Estate Projects with Pioneer Realty Capital

Fortunately for commercial real estate investors, Opportunity Zones provide a chance to take advantage of the new tax benefits for commercial real estate projects. Many investors today are hesitant to sell their businesses or stock shares due to tax implications, even if they have real estate goals on the horizon. Now, lenders such as Pioneer Realty Capital, LLC can include Opportunity Zones as part of the multifaceted financing plans required to structure debt and equity for real estate project funding.

Take Advantage of Tax Benefits that Create Opportunity for All

With the help of a highly qualified lender, taking full advantage of the new Opportunity Zone tax benefits is within reach. Invest in commercial real estate short-term for prior capital gains tax deferral, a few years for discounts, and even long-term for limitless tax-free gains. Drive economic growth to areas in need easily through a partnership or corporation and be a part of a nationwide economic solution that benefits communities and investors alike.

Get Social