When they hear the term ‘crowdfunding’, most people picture the charitable fundraising efforts of sites like GoFundMe. Or, perhaps the Kickstarter campaigns used to fund the launch of a new business venture come to mind.

Commercial real estate crowdfunding, however, is a little different.

While CRE crowdfunding relies on many investor contributions to fund one project, the similarities end there. Here’s a little history on where CRE crowdfunding got its start, and what interested investors need to know.

The JOBS Act Made CRE Crowdfunding Possible

In 2012, the Jumpstart Our Business Startups Act, or JOBS Act, brought big changes for small businesses and startups. Since businesses tend to operate in commercial properties, it also caught the attention of CRE professionals all over the country.

New exemptions meant companies could receive smaller investments without having to register for an IPO. This includes funding for commercial real estate. In the past, crossing a certain investor threshold or having too many assets would force filing for an IPO and going public. Thanks to the JOBS Act, this is less of a concern.

However, commercial property is still typically expensive—costing more than the small investment limits set by the new exemptions. The solution? Financing with multiple small investments through crowdfunding.

This wasn’t the only advantage fueling the CRE crowdfunding movement. Companies can now also have more shareholders without registering with the Securities and Exchange Commission, or SEC. Registration is now only required once a company exceeds $10 million in assets and has more than 500 shareholders. Also, any company with total gross revenue under $1 billion can still be considered an emerging growth company. This comes with additional benefits.

Finally, once companies do become public, they have five years to reach compliance with certain requirements. This is more than double the time allotted pre-2012, which was two years.

In a nutshell, startup CRE investing is easier post-JOBS Act. Companies can stay private for longer, granting more time for fundraising (and acquiring property) before going public.

How CRE Crowdfunding Works

For those interested in becoming a crowdfunding investor, it’s important to understand how the process works. Typically, investors search a crowdfunding platform for deals. When they find one they like, they commit to investing capital. Many investors come together and make smaller-than-traditional investments in a single property.

A group of investors in this situation is known as a syndicate. Because of this, crowdfunding is also sometimes called syndication. Syndication is far from new to CRE investing, but crowdfunding allows individual investors with less capital to partake in the practice.

A crowdfunding platform connects investors to sponsors. Sponsors are the companies that intend to acquire the property and carry out an investment strategy. Sponsors do all the work of negotiating a deal, hiring contractors, and managing and overseeing the project.

If Lyft were a crowdfunding platform, an investor would be a rider. The platform helps connect that rider to the best possible driver, who does all the work of getting the rider to their desired destination. While there’s a bit more homework for an investor than a rider, the relationship between user-platform-executer is similar.

From there, the process is much like any other profitable CRE investment. Income is derived from renting the space out and/or eventually selling the property. Sponsors also make money off of fees associated with handling the deal.

Why CRE Crowdfunding is Attractive

Crowdfunding is attractive for a few reasons:

- >Financial accessibility. Before crowdfunding, only large institutions were able to easily invest in commercial real estate. Think pension plans, hedge funds, and insurance companies. For an individual to invest, they’d have to not only have the right connections, but also at least $100,000. With crowdfunding, however, some platforms allow individuals to invest with as little as $11,000.

- >Lower knowledge barriers. In the past, knowing the right people and having a pulse on the market were critical to CRE investment success. While due diligence remains important for investors, many crowdfunding platforms offer tools and research to make this easier. Additionally, online marketplaces mean investors have most, if not all, of the information they need right at their fingertips. This is in addition to easy-to-access lines of communication to sponsors.

- >Versatility. CRE investing can grow wealth through cash income as well as appreciation. It also offers security and opportunities for leveraging. In 2018, the average preferred return for a syndication investor was 8%. Clearly, CRE investing can be lucrative when done right. It can even serve as a pillar for a diversified IRA.

Do I Have to Become an Accredited Investor?

An accredited investor is someone who meets certain financial standards laid out by the SEC. The purpose of these standards is to draw a line between more and less experienced investors. Due to the riskier nature of private CRE investments, many firms seek seasoned investors who understand what they’re getting into. Accredited investors tend to meet this expectation.

There is no training or exam to become accredited. Investors must simply have a net worth of over $1 million individually or combined with a spouse. They also must earn at least $200,000 a year in income, or $300,000 if combined with a spouse. This must be proven earned income for the previous two calendar years, and a candidate must prove they can maintain or increase these thresholds during the current year.

Meeting these requirements opens the door for investing with more firms. Each firm has its own screening process for potential investors, but being an accredited investor is often a baseline. Not all firms and crowdfunding platforms require accreditation. For unaccredited investors, it’s very important to perform due diligence before investing in CRE.

Commercial Real Estate Crowdfunding: Creating Opportunity

CRE companies in the future will need to find a balance between technology and real estate experts. They’ll have to select the best technology to succeed.

Crowdfunding opens many doors for investors and CRE professionals alike. Investor communities have already formed in crowdfunding marketplaces. As investors perform due diligence, many share their findings with fellow investors and compare notes. This communal continuing education makes for smarter groups of investors.

Opening commercial real estate to crowdfunding also diversifies the investor pool. It allows more people to invest while keeping their values in mind, such as helping underserved communities or prioritizing eco-friendly properties. It can even bring more women into CRE investment.

For those ready to dip their toe into CRE investing, opportunity abounds.

At Pioneer Realty Capital we always offer a personal level of service and expert advisory to investors and owners of commercial real estate. As experts in the industry, we constantly remain aware of CRE finance trends and investment opportunities. If you’re interested in a commercial real estate loan for any commercial property nationwide or need advice for your CRE financing, call 682-518-9416 to speak to a commercial real estate financing professional today.

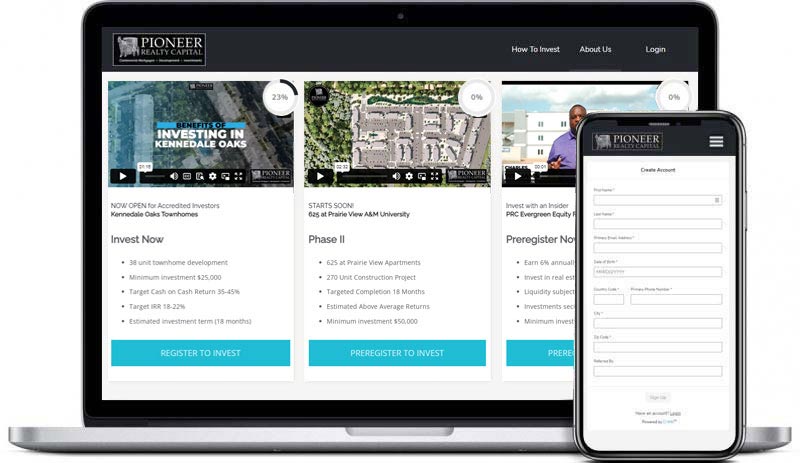

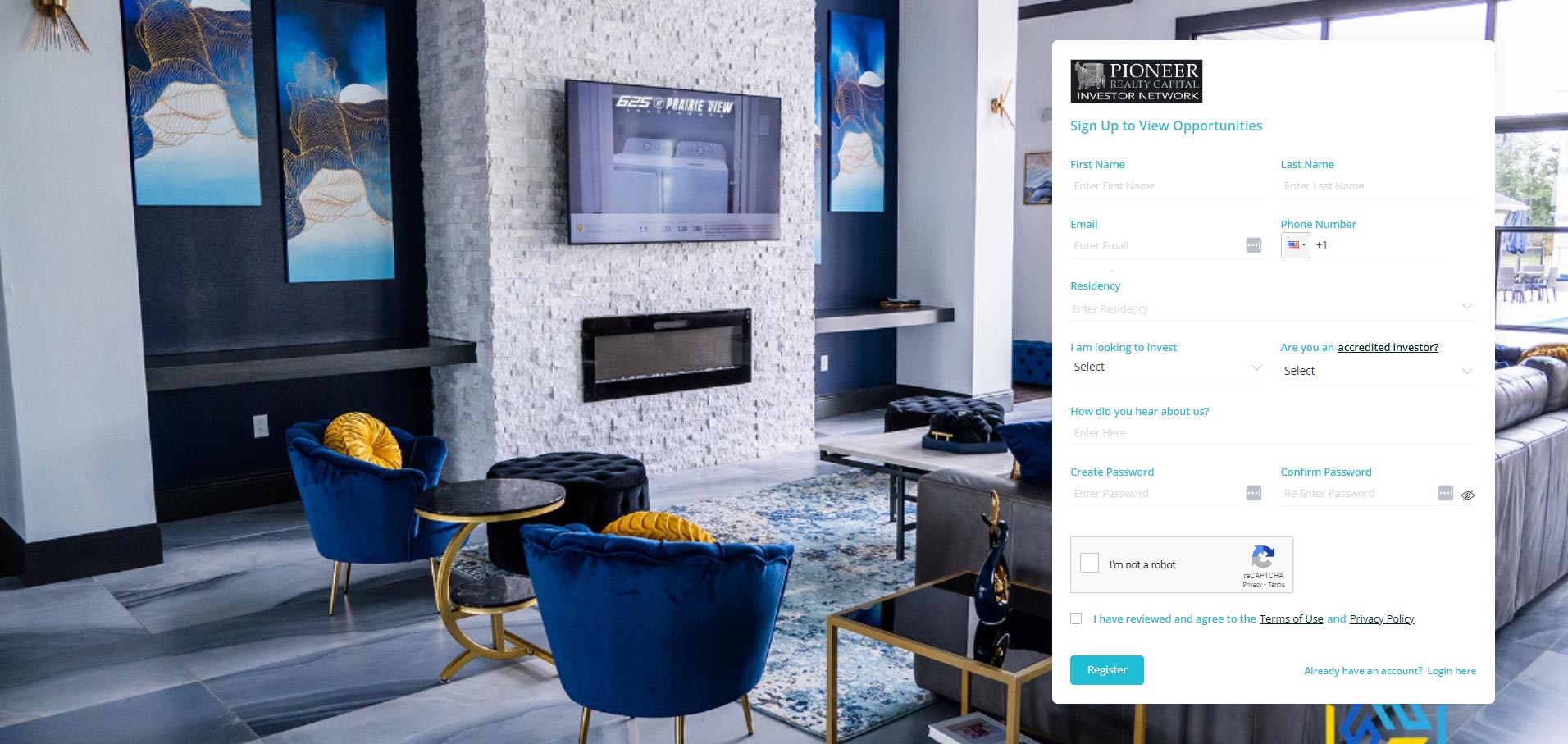

INVEST IN REAL ESTATE WITH AN INSIDER

We value our investors as family, and want to share our wealth of success in the commercial real estate industry with them as transparently as possible. Our award winning platform makes that possible. You can leverage our decades of experience, strong relationships, and expert advisory team to help you reach your financial goals through real estate investing. Investing with an insider has never been easier.

Get Social